views

Finance Minister Nirmala Sitharaman on Tuesday tweaked tax slabs under the new income tax regime to provide more money in the hands of the salaried class to boost consumption. She said salaried employees in the new tax regime could save up to Rs 17,500 in income tax annually following the changes announced in the Budget.

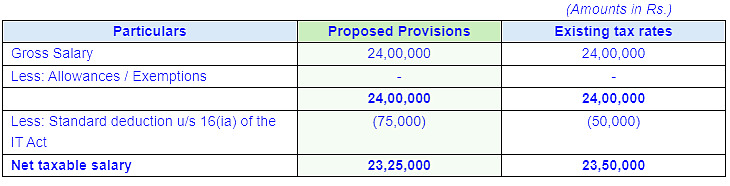

At the same time, she added that the standard deduction for salaried employees is proposed to be increased from Rs 50,000 to Rs 75,000 annually. Similarly, the pensioners’ family pension deduction is proposed to be enhanced from Rs 15,000 to Rs 25,000.

Sitharaman said income of up to Rs 3 lakh will continue to be exempted from income tax under the new regime.

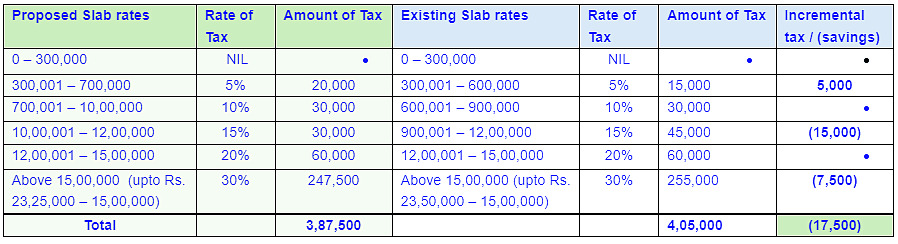

Many taxpayers took the calculation mode after the announcement made by the Finance Minister, on how they will save Rs 17,500 in taxes.

Dipesh Jain, Partner at Economic Laws Practice, elaborates;

The slab rate reduction effect will be Rs 10,000.

Standard deduction Rs 25,000 additional @ 30% = Rs 7,500

Tax Saving: Rs 10,000 + Rs 7,500 = Rs 17,500

CA (Dr.) Suresh Surana cracks the maths behind the FM’s statement.

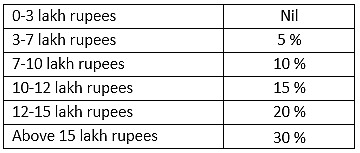

New Tax Slabs Under New Tax Regime

Let us understand the breakup for such savings of Rs. 17,500.

Revised / Proposed tax rates under the new tax regime under section 115BAC of the Income-tax Act, 1961 (Applicable form AY 2025-26)

Illustration: Assuming Mr. A is an employee of ABC Ltd. having a salary income of Rs. 24,00,000 under the new tax regime.

New Tax Slabs FY 2024-25

The new tax slabs under the latest income tax regime will be effective from April 1, 2024. (Assessment Year 2025-26).

More Relief Was Expected

Inderjeet Singh, CA, Partner, AHSG & Co LLP, said that the government has done a commendable job by relaxing individuals’ income tax slab.

“It is a great decision for middle-income groups. This group has been struggling to save and barely managed to save with existing tax saving schemes. This refreshing change will allow them to have increased income and contribute to their economic stability. Also, slightly more tax relief should be considered for the middle-class salaried people considering their low savings investments," Singh added.

Is the New Tax Regime Popular Now?

In the last fiscal, more than two-thirds of individual taxpayers have availed of the new personal income tax regime. Over 8.61 crore IT returns were filed in the 2023-24 fiscal.

Comments

0 comment