views

India is often called the Diabetes Capital of the World. With the diseases now affecting millions of individuals irrespective of age or gender, India indeed is home to a large number of Diabetic and pre-diabetic people with an alarming rise in young patients. To put it in perspective, in recent years, young adults in India have increasingly adopted a sedentary lifestyle, characterised by extended hours of screen time, decreased physical activity, and a shift towards convenience-based living.

Also Read: 18% GST On Life, Health Insurance: Is It Justified, And If So To What Extent?

All these factors have significantly contributed to an increase in lifestyle diseases including diabetes. Gone are the days when people only aged above 40 years used to be diabetic. Nowadays, young adults even in the age group of 30-35 years are suffering from Diabetes.

According to a 2021 study, the number of Indians diagnosed with diabetes increased by 31 million between 2019 and 2021. The study revealed that India has 101 million people living with diabetes and 136 million with prediabetes.

Moreover, the cost of critical illnesses like diabetes is surging exponentially. India has been clocking medical inflation at 14%. Considering the kind of critical diseases that Diabetes can lead to, robust health insurance coverage is necessary to battle medical expenses.

Product innovations

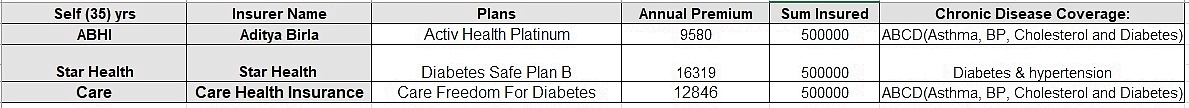

Nowadays, many insurers offer health insurance plans that provide early coverage for pre-existing diseases, even from day one at an additional cost of approximately 20%. Insurers provide coverage for both Type 1 and Type 2 diabetes, including individuals on insulin.

The outpatient department (OPD) coverage includes expenses for medicine, diagnostics, and consultations. Wellness discounts are available, offering up to 100% off for customers who take care of their health. Additionally, insurance companies accept diabetes customers with HbA1c levels up to 10.

Plans now offer early coverage for diabetes and cover outpatient department (OPD) benefits from day one and hospitalisation expenses after 30 days for diabetes-related complications. They often include a free chronic management program that activates if a chronic condition develops after purchasing the policy, offering doctor consultations (three visits), diagnostic tests (HbA1c and creatinine), and reward points for staying healthy that reduce premiums. Additionally, they provide access to experts in medical, nutritional, fitness, mental counselling, and homoeopathy teleconsultation.

Similarly, there are plans available to individuals with Type I or Type II Diabetes Mellitus and cover hospitalisation expenses, including room charges, surgeon’s fees, blood, oxygen, diagnostic expenses, and the cost of medicines and drugs. It also covers the cost of fasting, postprandial, and HbA1c tests once every six months, up to Rs.750 per event and Rs.1500 per policy period.

Day 1 coverage for diabetes and hypertension is also available with a discount of up to 20% for renewal. Health insurance premiums for these plans for a 29-year-old living in Delhi can range anywhere between Rs 10,000 and Rs 19,000 annually.

Disclose your medical history when buying health insurance

It is crucial to disclose your medical history when purchasing health insurance. Many people make the mistake of not doing so, which can lead to serious consequences, including claim rejections later on. If you have a pre-existing disease (PED), always read the policy’s terms and conditions carefully before buying. Check for sub-limits, co-payments, and room rent charges to avoid out-of-pocket expenses during hospitalisation.

Additionally, buying health insurance online is preferable as it is faster and reduces the chances of mis-selling. Nowadays, telemedical and videomedical services have been introduced, facilitating quicker policy issuance.

-The author is Head, Health Insurance, Policybazaar.com. Views expressed are personal.

Comments

0 comment