views

Written by Sidharth V:

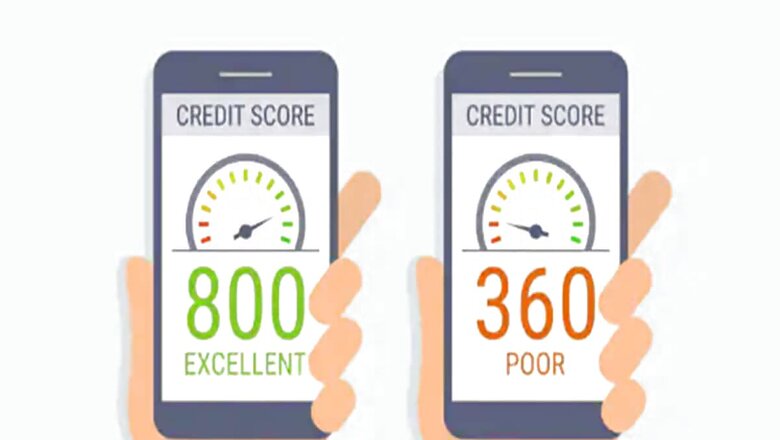

Building a strong credit score early in life is crucial for long-term financial stability and access to better financial opportunities in the future. A good credit score can open doors to favourable loan terms, lower interest rates, and even better job prospects. However, understanding how to establish and maintain a healthy credit score can be challenging for young individuals just starting out. Here are five essential tips to help you build a solid credit foundation and set yourself up for financial success:

Consider taking small-ticket loans to build credit: Small-ticket loans are loans of a small amount that are generally easier to pay off. As you successfully make each monthly repayment, your credit report will naturally improve.

Make timely credit payments: Timely credit payments increase your credit score by lowering your credit utilisation. This shows financial institutions that you are adept at managing monthly finances. If you miss a credit payment, you may accumulate high interest on those purchases for the next month. Thus, if you feel unequipped for a payment, consider a loan as this will generally have a lower interest and more flexible tenure.

Avoid having too many credit cards or credit lines: Having too many credit lines makes it difficult to track monthly payments. If you are in a situation like this, you can consider taking a personal loan to close all payments. This way, you only need to track one payment which makes building credit much easier.

Understand and check your credit report regularly: Your credit score will determine how financially responsible you are perceived to be. Thus, it is imperative to review your credit report regularly to see how you can improve your credit report.

Don’t be afraid to use loans: Loans can be a valuable method for improving your credit profile as a new starter. Use loans to enhance your finances and upgrade your lifestyle without negatively impacting credit utilisation.

These tips can help you achieve an elevated credit profile so economic institutions have increased trust in your financial capabilities. Just review your credit report and make the needed payments regularly and take support from loans whenever needed.

(The author is the chief risk officer, KreditBee)

Comments

0 comment