views

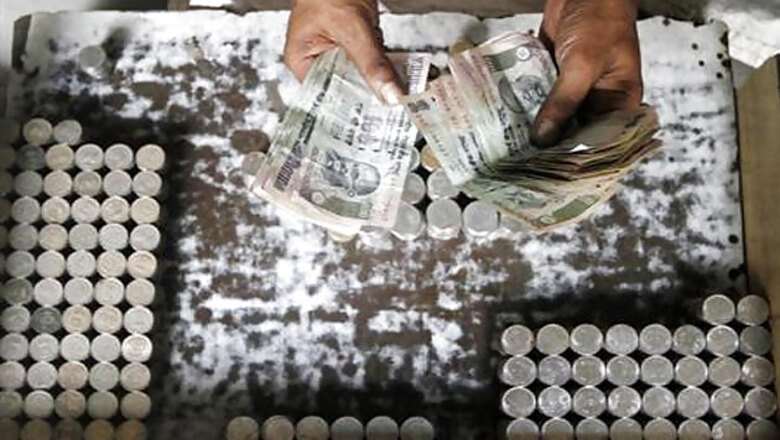

The rupee remained frail after last week's record low, as pessimism generated by dismal economic growth data was compounded on Monday by survey showing factory activity in August shrank for the first time in over four years.

Investors want bold reforms to restore confidence in India, spur growth, reduce a record current account gap, while keeping a worryingly high fiscal deficit under control.

Measures taken by Prime Minister Manmohan Singh's minority government since the rupee began its slide in May have left the market unimpressed, and there are fears that the ruling coalition will put politics before the urgent needs of the economy with an election due by May next year.

Quoted at 66.09 per dollar by midday, the rupee was just a touch weaker than Friday's close of 65.70/71, and still within easy striking distance of the all time low of 68.85 to the dollar struck on August 28.

Aggressive intervention by the Reserve Bank of India had helped lift the rupee off its low late last week. The RBI's main defence, squeezing rupee liquidity and pushing up short term interest rates, has pushed up borrowing costs for already depressed corporates, but has barely stemmed the rupee's fall.

The rupee has depreciated around 16 percent since May, and has fared worse than other emerging market currencies that have been hit since the US Federal Reserve first hinted that it was considering tapering off its bond buying stimulus.

Raghuram Rajan, a vaunted former chief economist at the International Monetary Fund, will step into his new role as RBI governor on Thursday, having been the chief economic advisor at the finance ministry for the past year.

But there was little to cheer, as the gross domestic product data released on Friday showed the economy had grown at a weaker than expected 4.4 percent in the April-June quarter from a year earlier, the slowest quarterly rate since the global financial crisis four years ago.

On Monday, the HSBC manufacturing purchasing managers index (PMI) report, compiled by Markit, piled on the misery.

The overall index sank to 48.5 in August from 50.1 in July, falling below the watershed 50-level that separates growth from contraction and marking its lowest reading since March 2009.

The survey showed factories cut production in August, with the sub-index measuring output falling to its lowest since early 2009. Manufacturers' reported total orders fell for a third straight month,and at a faster pace in August, while new orders for exports shrank for the first time in a year.

"The fact that growth momentum has waned so significantly, yet not enough to ameliorate the external deficit is particularly worrying," said Sacha Tihanyi, senior currency strategist at Scotiabank.

"It simply underscores the very, very worrying position that India's policymakers find themselves in."

Faced with a brewing currency crisis, India is seeking support from other emerging market countries for coordinated intervention in offshore foreign exchange markets, but at least one critical partner, Brazil, said it is not involved in such planning at this time, while others declined comment.

The weak data is prompting banks to predict Asia's third-largest economy will grow this year even below the decade-low of 5 percent in the year ended in March.

HSBC on Monday cut its growth forecast for the year ending in March to 4 percent from its earlier 5.5 percent forecast, while Nomura on Friday cut its GDP forecast to 4.2 percent from 5 percent earlier.

Looking to trim the oil import bill, Oil Minister M. Veerappa Moily has recommended to Singh that India buy more crude oil from Iran, which would accept payment in rupees, regardless of US sanctions on Tehran.

There are also calls for an increase in state-controlled diesel prices, in order to curb imports and reduce the subsidy burden. On Sunday, Indian Oil Corp Ltd (IOC) (IOC.NS), the country's biggest refiner, raised petrol prices by 4 percent and diesel by 1.1 percent.

Comments

0 comment