views

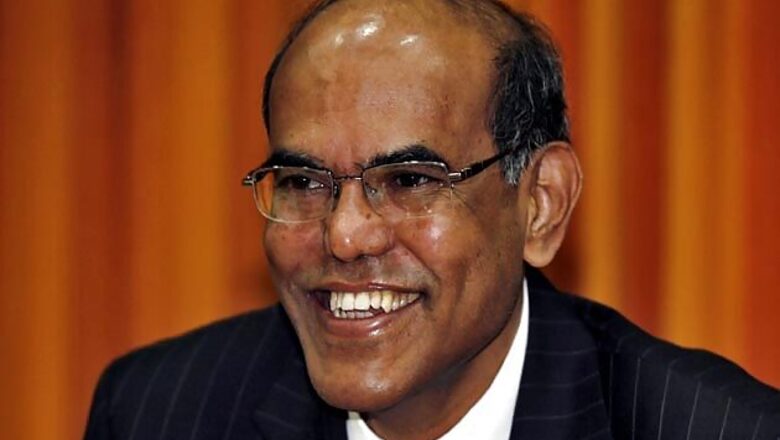

RBI Governor D Subbarao on Thursday presented an uncertain outlook for the economy, saying it is difficult to predict when global conditions affecting the rupee would ease, while asserting that the priority is to control inflation, which still remains "high." "The rupee depreciation over the last six weeks has been because of global factors...It is difficult to say how long that effect will persist because it is factors beyond our control," he told reporters in Indore.

The rupee has declined by about 9 per cent in the past three months and had touched a record low of 61.21 to the dollar on July 8. The currency recovered after the RBI and Sebi announced measures to curb volatility and speculation in the currency derivative market.

The rupee, which climbed to a one-week high on Thursday, wiped out the day's gains and weakened by two paise to 59.67 at the close on fresh demand for dollars from importers. On the possibility of a rate cut, Subbarao said he would assess growth, inflation and the external situation while taking a view in the upcoming policy on July 30.

The central bank will accord priority to controlling inflation, which still remains "high," Subbarao told a gathering during an outreach programme in Khurda village earlier in the day. The RBI's efforts to contain inflation have yielded fruit, with the wholesale price index declining to 4.7 per cent, the lowest in over three years.

However, retail inflation stood at 9.31 per cent in May. The current account deficit remains high, Subbarao said. The CAD hit a record high of 4.8 per cent in the last fiscal. In view of the declining value of the rupee, fears of inflation and the high CAD, the RBI left interest rates unchanged during the last policy review in June.

The apex bank would look at supporting growth but would make efforts to keep inflation low. The outflow of foreign funds to the tune of USD 7 billion in June alone, following concerns about the tapering of bond purchases by the US government, has put pressure on the rupee.

Comments

0 comment