views

Sending the First Notice

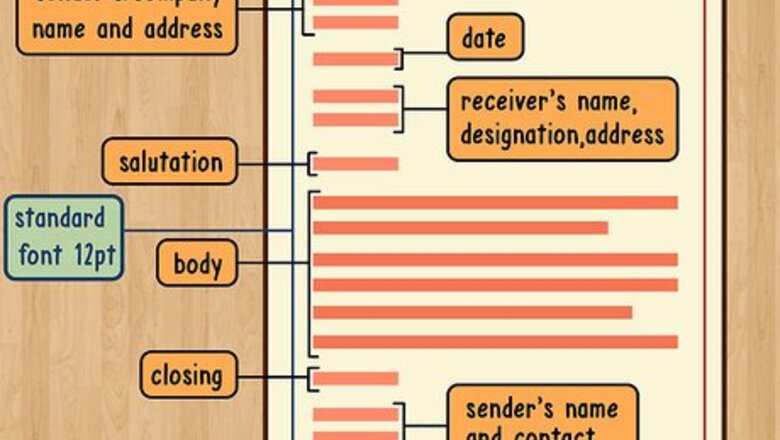

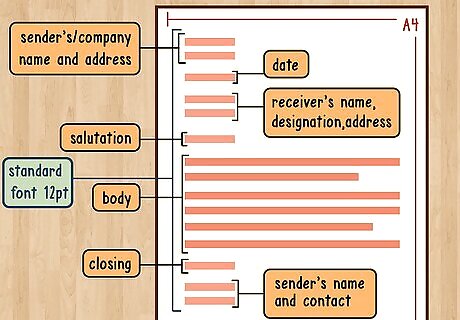

Format your letter. Your letter should be set up like a standard business letter. Set the font to something readable—usually Times New Roman 12 point works for most readers. Remember to include the date that you are sending the letter. If you don’t use company letterhead, then you need to include your business address at the top.

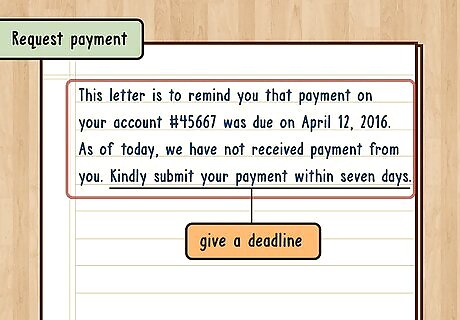

Request payment. You should mail out an initial reminder the first day that payment is due. You want to use a friendly tone. After all, the customer may have simply forgotten that payment was due or a check might even be in the mail. Make sure to give the customer a deadline for paying. You could write: “This letter is to remind you that payment on your account #45667 was due on April 12, 2016. As of today, we have not received payment from you. Kindly submit your payment within seven days.” You might be willing to offer a payment plan. If so, then mention that in the letter. For example, you might accept half of the amount due this month and the other half a month later.

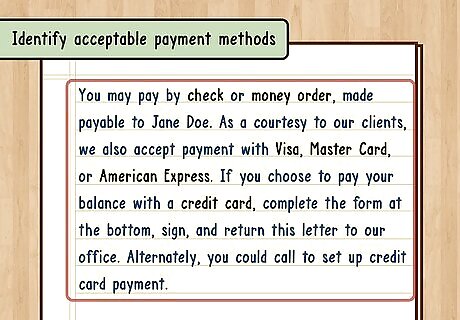

Identify acceptable payment methods. You don’t want the customer to send you payment using a method you don’t accept. To protect yourself, explicitly state what payment methods you accept—personal check, money order, cash, or credit card (such as Visa, MasterCard, Discover, American Express, etc.) If credit card payment is an option, include lines at the bottom of your letter for the card number, expiration date, cardholder name, signature, and the amount to be charged. For example, you could write: “You may pay by check or money order, made payable to [insert your name]. As a courtesy to our clients, we also accept payment with Visa, Master Card, or American Express. If you choose to pay your balance with a credit card, complete the form at the bottom, sign, and return this letter to our office. Alternately, you could call to set up credit card payment.”

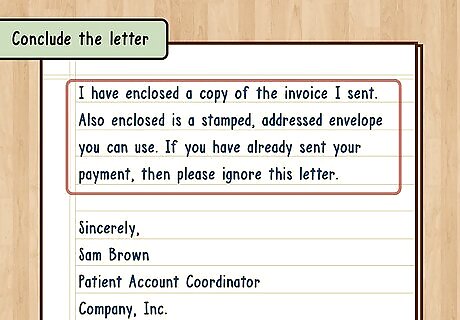

Conclude the letter. You should tell the customer what attachments you have included. Also make sure to tell them to disregard the letter if payment has already been sent. If your letterhead doesn’t contain a phone number or email address, then you should provide that information as well. For example, you could write, “I have enclosed a copy of the invoice I sent. Also enclosed is a stamped, addressed envelope you can use. If you have already sent your payment, then please ignore this letter.” Remember to sign your letter. Also include your title, e.g., Patient Account Coordinator.

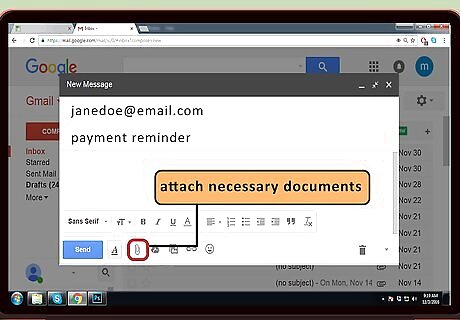

Send the notice to the customer. You can send the letter using email or by mail. If you send by mail, then it’s best to send certified mail, return receipt requested. This will show that the customer has received your reminder. Don’t forget to include any enclosures, such as a copy of the invoice or an envelope. If you send this notice by email, then send attachments as PDFs.

Mailing a Firm Reminder

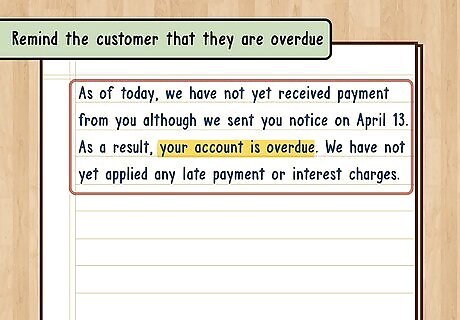

Remind the customer that they are overdue. Prepare a second letter using the same format as the first. Remember to mention that you have already sent a first notice but you haven’t heard anything. If you’ve added late fees, charges, or interest, make sure to mention that. Adopt a serious tone. Your first reminder was friendly, but now you need to start being serious. For example, you could write, “As of today, we have not yet received payment from you although we sent you notice on April 13. As a result, your account is overdue. We have not yet applied any late payment or interest charges.”

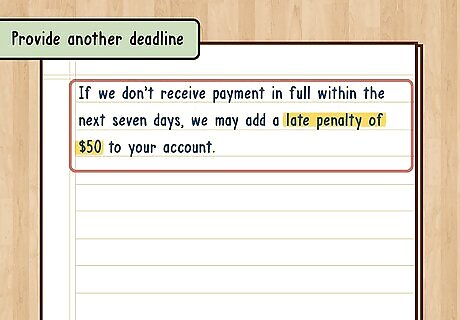

Provide another deadline. Give the customer another seven days or so to send payment. Also remind them of the consequences if they don’t pay up. For example, you might add late fees or other charges. Sample language could read: “If we don’t receive payment in full within the next seven days, we may add a late penalty of $50 to your account.” You can remind the customer of your acceptable payment methods, using the same language that you used in your first notice.

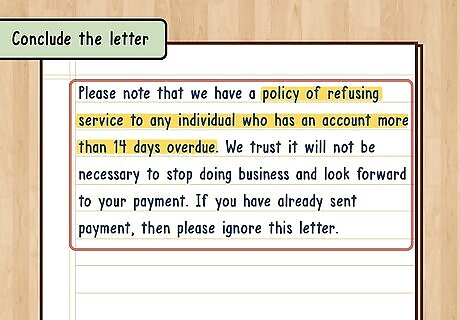

Conclude the letter. You can tell the customer what will happen if they don’t pay up. For example, you might have a policy of no longer doing business with someone if they are late with their payments. For example, you could write: “Please note that we have a policy of refusing service to any individual who has an account more than 14 days overdue. We trust it will not be necessary to stop doing business and look forward to your payment. If you have already sent payment, then please ignore this letter.” You shouldn’t email this notice. Instead, mail it certified mail, return receipt requested. Always keep a copy for your own records.

Sending the Final Demand Letter

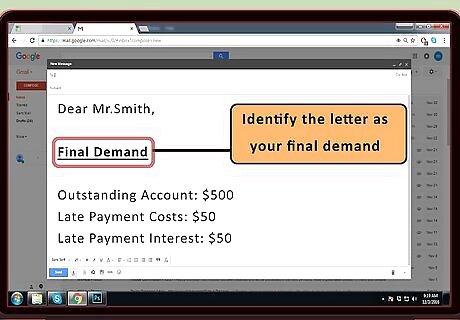

Identify the letter as your final demand. Set up the letter as a standard business letter. However, also include a heading, such as the words “Final Demand.” Put the words in bold and underline them. You want the recipient to know that this is their last chance to pay up before you take additional action.

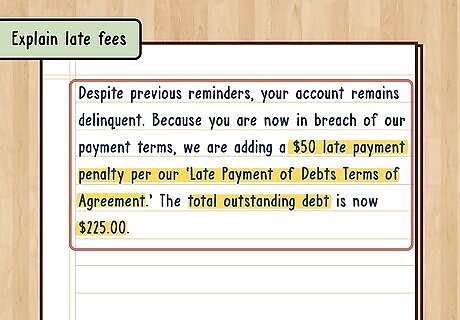

Explain late fees. You should tell the customer that they are now in breach of your agreement and that you have added interest or a penalty for being late. Then tell them the new total amount they need to pay. Sample language could read: “Despite previous reminders, your account remains delinquent. Because you are now in breach of our payment terms, we are adding a $50 late payment penalty per our ‘Late Payment of Debts Terms of Agreement.’ The total outstanding debt is now $225.00.”

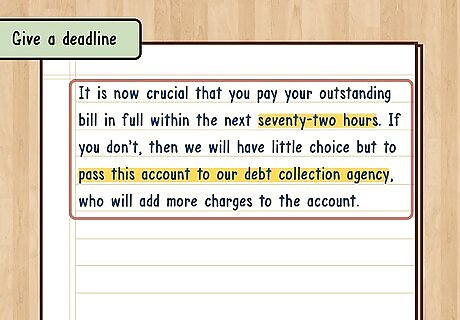

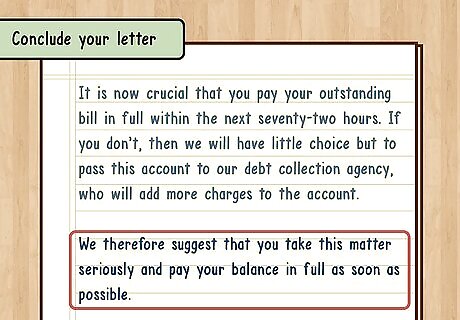

Give a deadline. You should tell the customer how much time they have to make final payment. You should not give them too much time. For example, you could set a 72-hour deadline. Explain what will happen if the customer doesn’t meet the deadline. For example, you might pass the account onto collections or sue the customer in court. Sample language could read: “It is now crucial that you pay your outstanding bill in full within the next seventy-two hours. If you don’t, then we will have little choice but to pass this account to our debt collection agency, who will add more charges to the account.” You can bold the “seventy-two hours” to make those words stand out.

Conclude your letter. Emphasize that the client should take this final demand letter seriously and pay up. For example, you could write, “We therefore suggest that you take this matter seriously and pay your balance in full as soon as possible.”

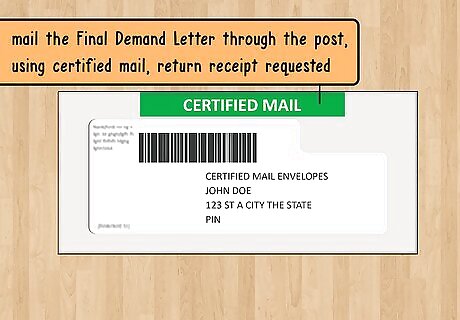

Mail the letter. You should send this one through the post, using certified mail, return receipt requested. If you don’t hear back from the customer, then go ahead and send the account to collections or sue—whichever you threatened in the letter.

Comments

0 comment