views

Preparing to Write

Decide on a time frame. Before you begin, you will need to determine the period of time your financial report will cover. Most financial reports are prepared quarterly and annually, although some companies also prepare them on a monthly basis. To determine the period of time your financial report should cover, review the governing documents of your organization, such as the bylaws, corporate charter or articles of incorporation. These documents may describe how often the financial report should be prepared. Ask an executive at your organization how frequently reports are expected to be prepared. If you are the executive of your own organization, consider when the financial report would be most useful to you and select that as your financial report date.

Review your ledgers. Next, you'll need to make sure everything in your ledgers is up to date and properly recorded. Your financial report will not be useful to readers unless the underlying accounting data is correct. For example, make sure all accounts payable and receivable have been processed, verify that the bank reconciliation is complete, and ascertain whether all inventory purchases and product sales have been recorded. You'll also need to consider any liabilities that may be unrecorded as of the financial report date. For example, has the company received any services that have not been invoiced? Are employees owed wages that have not yet been paid? These items represent accrued liabilities and must be recorded in the financial statements.

Gather any missing information. If your review of the ledgers reveals any missing information, track down any pertinent documents you'll need to ensure that your financial report is complete and correct.

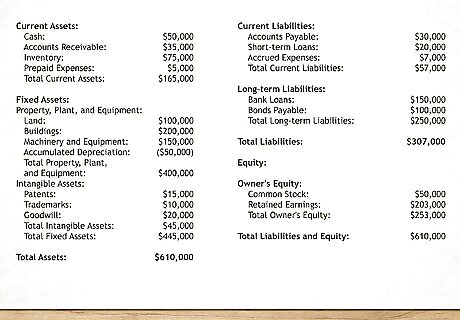

Preparing the Balance Sheet

Set up the balance sheet page. A balance sheet shows the company's assets (what it owns), liabilities (what it owes) and equity accounts, such as common stock and additional paid-in capital for a specific date. Title the first page of your financial report “Balance Sheet” and then list the organization's name and the balance sheet's effective date. The balance sheet items are reported as of a specific day of the year. For example, the balance may be prepared as of December 31.

Format your balance sheet appropriately. Most balance sheets feature assets on the left and liabilities/equity on the right. Alternatively, some may show assets on top and liabilities/equity below.

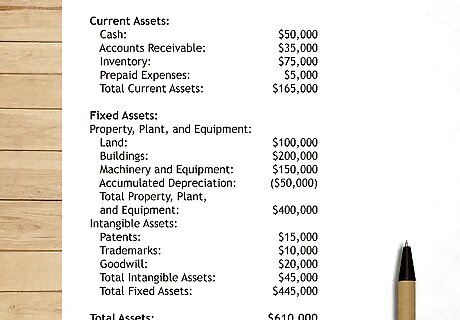

List your assets. Add the title “Assets” to first section of the balance sheet, then list the different assets held by the company. Start with current assets, such as cash and any items that will be converted to cash within one year of the balance sheet date. At the end of this section, include a subtotal of the current assets. Next, list the non-current assets. Non-current assets are defined as any assets that are not in the form of cash and will not be converted to cash any time soon. For example, property, equipment and notes receivable are non-current assets. Include a subtotal of the non-current assets. Finally, sum the current and non-current subtotals and label this line “Total Assets.”

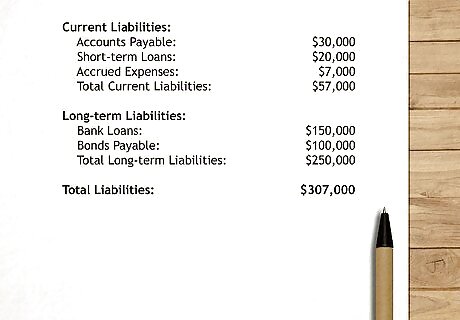

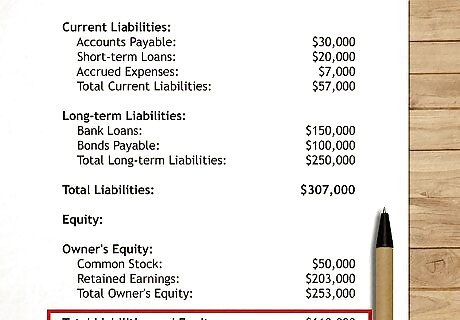

List your liabilities. The next section of the balance sheet shows the liabilities and equity accounts. This section of the balance sheet should be titled “Liabilities and Equity.” Begin by listing current liabilities. These are liabilities that are due within one year, and typically include accounts payable, accrued liabilities and the short-term portion of mortgages and other loan payments. Include a subtotal of the current liabilities. Next, include the long-term liabilities. These are any liabilities that will not be settled within one year, such as long-term debt and notes payable. Include a subtotal of long-term liabilities. Sum the current and non-current subtotals and label this line “Total Liabilities.”

List all sources of equity. The equity section of the balance sheet comes after the liabilities portion and shows the amount of money the company would have left if all its assets were sold and liabilities paid off. Here, make a list of all the equity accounts, such as common stock, treasury stock and retained earnings. Once all the equity accounts are listed, sum them and add the caption “Total Equity.”

Add up the liabilities and equity. Combine the totals from “Total Liabilities” and “Total Equity” sections together. Title this “Total Liabilities and Equity.”

Check the balance. The figures you have calculated for “Total Assets” and “Total Liabilities and Equity” must be equal on the balance sheet. If this is the case, then your balance sheet is now complete and you can begin preparing the income statement. Shareholder's equity should correspond to a company's assets minus its liabilities. As mentioned previously, this is the money that would be left over if all assets were sold and all liabilities paid. Hence, liabilities plus equity should be equal to assets. If the balance sheet does not balance, double check your work. You may have omitted or miscategorized one of your accounts. Double check each column individually and make sure everything is included that ought to be. You may have missed a valuable asset, or a significant liability.

Preparing the Income Statement

Set up the income statement page. The income statement shows how much money a company earned and spent over a period time. Title this page of your report “Income Statement” and list the organization's name and the period of time the income statement will cover. For example, an income statement is often drafted for the period from January 1 to December 31 of a particular year. Note that it is possible to prepare a financial report for a single quarter or month, while your income statement might be for a full year. Your financial report will be easier for readers to understand if they are for the same period, but this isn't strictly necessary.

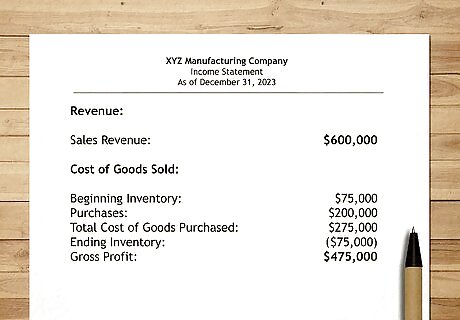

List sources of revenue. List the different sources of income and the amounts that were earned. Be sure to report each type of revenue separately, adjusted as necessary for any sales discounts or return allowances, for example: “Sales, $10,000” and “Service Income, $5,000.” Organize the sources of revenue in a way that is meaningful to the company. Some options may be revenue by geographical region, by management team or by specific product. When all revenue sources have been included, sum them and report the total as “Total Revenue.”

Report the costs of goods sold. This is the total cost of developing or manufacturing your product or providing your service in the reporting period. To calculate a cost of goods, you should add the direct materials, direct labor, factory costs and shipping or delivery expenses. Subtract cost of goods sold from total revenue and title this number “Gross Profit.”

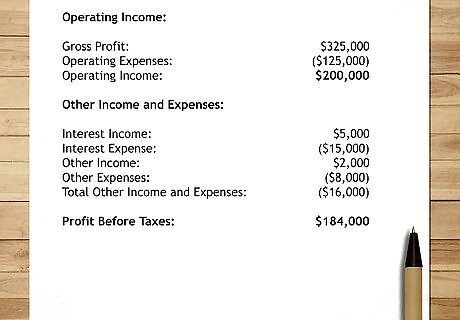

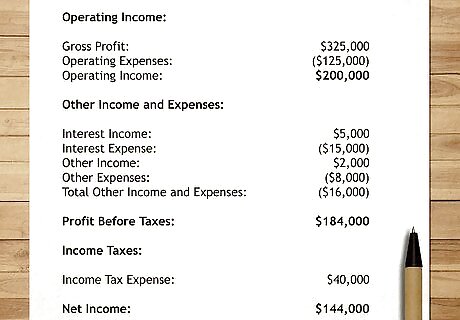

Record operating expenses. Operating expenses include all of the expenses that are necessary for conducting your business. This includes general and administrative expenses, such as salaries, rent, utilities and depreciation of properties. It also includes advertising and research and development expenses. You may want to record these expenses separately so that the readers of your report can get an overall idea of where money is being spent. Subtract the sum of these costs from your gross profit and title this number “Profit Before Taxes.”

Include retained earnings. "Retained earnings" refers the sum of all net income and net losses since the organization was founded. Adding retained earnings from the beginning of the year to the current year's net income or loss results in the total retained earnings balance.

Preparing a Statement of Cash Flows

Set up your cash flows statement page. This statement tracks the sources and uses of cash by the company. Title this page “Statement of Cash Flows” and list the organization's name and the period of time the statement will cover. Similar to the income statement, the statement of cash flows covers a period of time, such as January 1 to December 31.

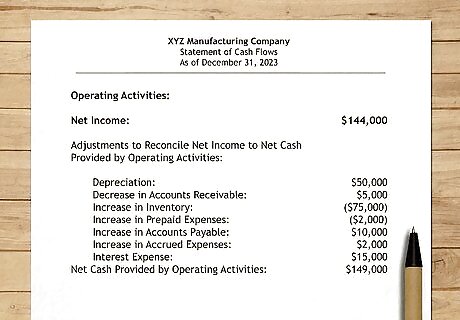

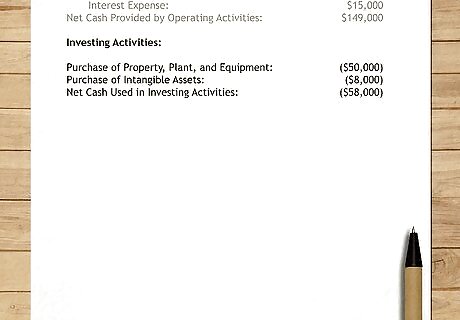

Create an operating activities section. The statement of cash flows begins with a section you should title “Cash Flows from Operating Activities.” This section corresponds to the income statement you already prepared. List the operating activities of the organization. This may include items such as cash receipts from sales and cash paid for inventory. Subtotal these items and label the resulting total “Net Cash Provided by Operating Activities.”

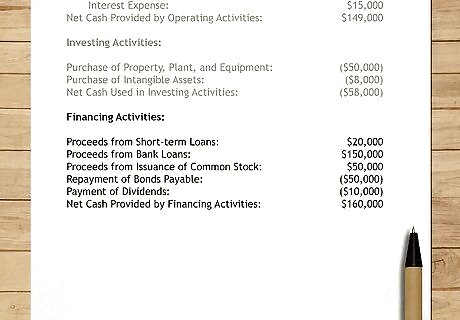

Create an investing activities section. Add a section titled “Cash Flows from Investing Activities.” This section corresponds to the balance sheet already prepared. This section relates to cash paid or received from investments in property and equipment, or investments in securities, such as stocks and bonds. Add a subtotal called “Net Cash Provided by Investing Activities.”

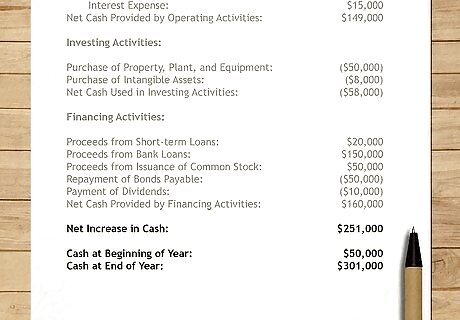

Include financing activities. The last section of this page should be titled “Cash Flows from Financing Activities.” This section relates to the equity portion of the balance sheet. This section should shows inflows and outflows from securities and debt issued by the organization. Add a subtotal called “Net Cash Provided by Financing Activities.”

Sum up the categories. Sum the three categories in the statement of cash flows, and label this number as the "Increase or Decrease in Cash" during the period. You can add the increase or decrease in cash to the cash balance at the beginning of the period. The sum of these two numbers should equal the cash balance shown on your balance sheet.

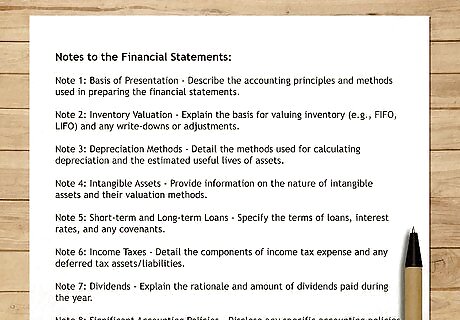

Add any important notes or narrative. Financial reports often include a section called “Notes to the Financial Statements,” which contain significant information about the company. Consider what additional information about the finances of the organization would be most useful to include in the “Notes” and then add this information to your report. The notes might contain information about company history, future plans or industry information. This is your opportunity to explain to investors what the report means and what it shows or doesn't show. It can help potential investors see the company through your eyes. Typically, the notes also include an explanation of accounting practices and procedures used by the company and explanations of balance sheet captions. This section also often includes details about the company's tax situation, pension plans, and stock options.

Comments

0 comment