views

X

Research source

Making Small Transfers Online

Choose a website or app that allows transfers to the UK. Typically, online money transfer services have both a website and a mobile app. You can set up an account on either. While there are many different money transfer apps, not all of them support international money transfers. Additionally, some only do international transfers to specific countries. Each app also has maximum transfer limits, so make sure the app you choose will allow you to send the amount of money you need to. For example, the Western Union app allows you to send up to US $500 (about £376). PayPal's limit, on the other hand, can go as high as US $10,000 (about £7,500), provided your account is verified. Compare the fees of apps as well. Some have relatively low fees, while others vary the fees depending on where you're sending the money from and how you're paying the money. While many mobile apps have relatively low up-front fees, they may also charge exchange rate markups of 1 to 3%.

Link a bank account or credit card. If you don't already have one, you'll need to set up an account with the service before you can use the app. Once you've set up your account, you'll need to add a debit or credit card, or providing the account number and routing number (also known as a sort code) for your bank account. Fees may be lower if you use a bank account rather than a credit or debit card. Some apps also have an identity verification process. Once you're verified, you may be able to send more money or have the money get to its recipient more quickly.

Enter the required information to send the money. The information you'll have to provide to send money to someone using a website or app depends on the service you're using. For some apps, all you need is their phone number or email address. For example, if you're using PayPal, you can send money to any phone number or email address — that's the only information you need to know. However, the person receiving the money will have to set up a PayPal account if they don't already have one so they can gain access to the money you sent. Western Union's app simplifies the transfer form as much as possible, although you'll still need to choose a location if the person receiving the money is going to pick it up from a Western Union agent.Tip: Some apps may require the other person to have an account with the service before you can send money to them. Make sure the person is familiar with the app and can access it before you send the money.

Confirm that the other person has received the money. When you send money through a website or mobile app, the recipient typically gets it within a few minutes. However, international transfers can take a little longer. Most mobile apps allow you to track the transfer from the app so that you can see for yourself when the recipient gets it.

Completing a Wire Transfer

Compare costs at several banks and wire transfer services. You can probably do a wire transfer to the UK directly from your bank. However, banks usually have higher fees than independent wire transfer services, and may not have the best exchange rates. To compare the cost for services, look at the fees, exchange rates, and any markup the bank or wire transfer service charges on the exchange rate. Banks typically have higher limits than basic wire transfer services, which can be helpful if you need to send a significant amount of money at once, such as to make a down payment on real estate in the UK. Essentially, you want to make sure that you're getting the best possible exchange rate so you can send the most money, and that you're paying the lowest possible fees.Tip: Some banks offer free transfers between linked accounts or accounts in an international branch of the same banking institution.

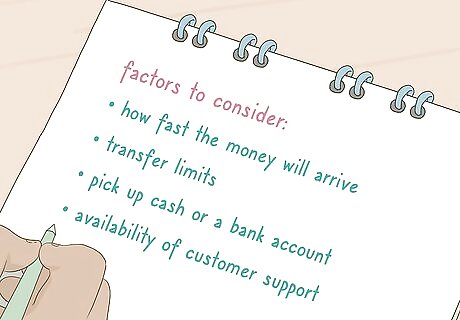

Choose a wire transfer service that best suits your needs. In addition to costs, other factors may affect which wire transfer service you can use. While you'll typically want the wire transfer service with the lowest fees and best exchange rates, other things you should consider include: How fast the money will arrive (typically same-day, but also depends on bank hours) Transfer limits Options for the recipient to get the money (some allow them to pick up cash, while others require them to have a bank account) The availability of customer support if you have problems with the transaction (especially important if you're transferring a significant amount of money)

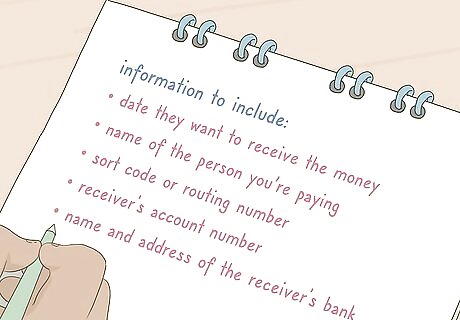

Get information from the person you're sending the money to. If the person is going to pick up cash in person, you may need nothing more than their name. However, you'll typically need more than that, especially if you're transferring a significant amount of money. Information you may need includes: The date the person wants to receive the money The name of the person you're paying The sort code or routing number of the account you're sending the money to (6 digits long for UK bank accounts) The account number of the account you're sending the money to (8 digits long for UK bank accounts The name and address of the bank you're sending the money to

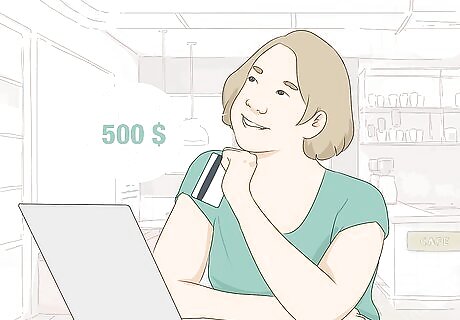

Decide how much money you want to send. When you make your transfer, you can choose to send a specific amount of British pounds or to send a specific amount in your national currency. That currency would then be converted into British pounds. For example, if you're simply sending some money to a friend or family member as a gift or a loan, you may not need to specify an exact amount of British pounds. You can simply send your money, then they'll get however much they can at the exchange rate used by the transfer service. On the other hand, if you're paying for something specific, you would typically want to send a specific amount of British pounds. The amount this would cost you in your national currency would then depend on the exchange rate.

Determine whether you want a spot contract or forward contract. With a spot contract, you get the exchange rate provided when you submit your transfer request. If you do a forward contract, on the other hand, you fix the rate but arrange for the transfer to take place at a later date. Rates for forward contracts are generally not as good as rates for spot contracts. However, if you decide to do a forward contract, you have 3 transfer types to choose from: With a limit order, you choose the rate you want and the transfer occurs when that rate is available With a stop loss order, you choose a lower limit for the exchange rate to fall. Your transfer occurs when the rate falls below that limit. With regular payments, you arrange multiple payments over a given period, all at the same exchange rate.

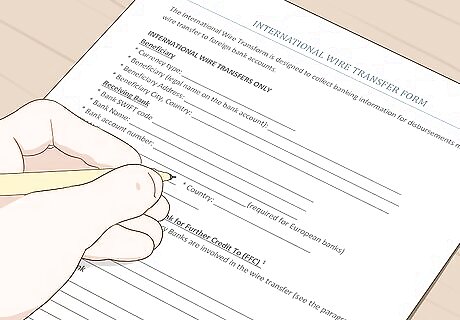

Fill out a form to transfer the money. The bank or wire transfer service will provide you with a wire transfer request form. Enter your personal information and bank information, as well as personal and banking information for the person you're sending the money to. Double check banking information before you submit the form to make sure you wrote down all the numbers correctly.

Let the other person know the transaction is complete. The bank or wire transfer service may give you a confirmation or reference number for the transaction. Give that information to the person you're sending money to so they can track the transfer and know when the money is available for them. Some banks or wire transfer services may require the person receiving the money to provide a code or other information to confirm that they are the intended recipient. They may also need to show a photo ID if they're picking up the money in person.

Comments

0 comment