views

Can you get free solar panels from the government?

The U.S. federal government doesn’t offer free solar panels. Some state government agencies have created programs to subsidize solar panels, but these are only available for low-income families who meet certain requirements. Solar panels can be installed by private companies with no up-front cost, but this doesn’t mean you won’t pay later on. The phrase “free solar panels” is a misleading marketing tactic that solar companies use to refer to a solar lease agreement or power purchase agreement (PPA). These agreements mean that you pay no upfront cost, but you pay a monthly fee to rent solar panels. If you believe a solar company is misrepresenting its products, contact the Federal Trade Commission and a state protection office in your state or territory.

How do companies mean by “free” solar panels?

A company may actually be pushing a solar lease. With a solar lease, a solar company installs their panels on your property for $0 upfront and asks you to sign a contract where you agree to pay a monthly fee to use them. Some companies might misrepresent leases as “free” because you don’t pay money upfront—however, you still have to pay a monthly fee. Pros: You don’t pay the initial cost of the panels, which can range from $8,500 to $30,500. Leases also take less toll on your credit score and your solar company has to pay for any repairs, maintenance, or part replacements. Cons: You don’t own the panels and can’t benefit from cost-reducing incentives like federal tax credits. Most leases have a term between 15 to 20 years, and if you sell your home before then, the new owner has to agree to take over the payments.

Or, they may be offering a power purchase agreement (PPA). With a PPA, the solar company installs the panels with no initial cost, but instead of a fixed monthly payment, you pay for the electricity the solar panels generate. Some companies set the PPA cost lower than local electric rates to make it more appealing and advertise these agreements as “free” because there’s no upfront cost. Pros: When solar panels have a low energy production during winter or cloudy days, your PPA payment is reduced for that month. Cons: You don’t own the panels and miss out on cost-saving incentive programs. Most PPAs also have a 20-year term, and if you have a new owner, they have to agree to take over the payments. Some also have escalator clauses, which means the amount you pay increases along with inflation and local utility rates.

State Solar Programs for Low-Income Families

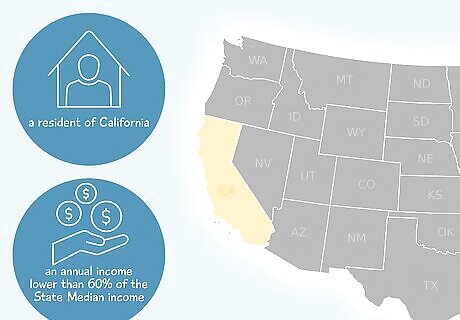

California Low-Income Weatherization Program (LIWP) California provides low-income households with solar panel systems and energy-efficient upgrades at no cost. Find and contact a local provider to apply. To qualify, you must meet these requirements: Be a resident of California. Have an annual household income (before taxes) that is lower than 60% of the State Median income. Preference is given to people over 60 years old, families with one or more members who have a disability, and families with children.

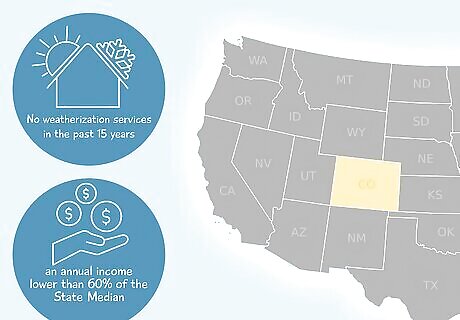

Colorado Weatherization Assistance Program (WAP) Every state has WAP programs, but Colorado was the first to include solar panel installation as part of their services. To start the process, find your local weatherization service provider and fill out an online application. To be eligible, your home must: Not have had any weatherization services in the past 15 years. Receive financial assistance from AND, TANF, SSI, SNAP, or LEAP or have an annual household income (for 1 to 7 members) that is lower than 60% of the State Median.

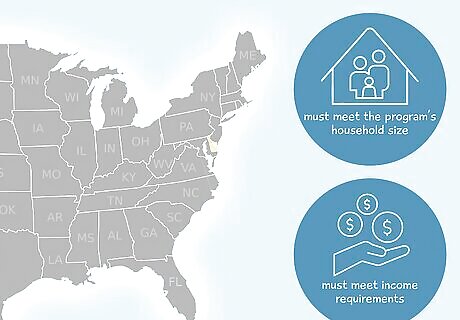

Delaware Low- to Moderate-Income (LMI) Solar Pilot Program Low-income households apply through Delaware’s Weatherization Assistance Program to receive a cost-free installation of up to 4.0 kW. Qualified moderate-income households can get a solar installation 70% paid for by LMI for a system up to 6.0 kW. Low-income qualifications: You must meet the program’s household size and income requirements. Moderate-income qualifications: You must meet the household size and income requirements and each adult household member will complete a 4506-C tax return form.

Other states may offer low-interest solar panel loans. States like Massachusetts or New York offer low-interest solar loan programs for moderate-income homeowners. Check your state’s website to see if they offer a solar panel loan program for households and homeowners. Use the search bar or go to your state website’s “programs” or “housing and utilities” page and look for energy assistance or solar panel programs. Other states may offer solar grants and loan funds to businesses, economic development organizations, and political subdivisions.

Reducing the Cost of Owned Solar Panels

Solar tax credits The federal solar investment tax credit (ITC) gives you back 30% of your installation costs in the form of tax deductions if you install a solar system between 2022 and 2032. Solar energy contractor Guy Gabay says this means “the IRS is willing to pay a homeowner through the tax credit up to what their total tax liability is for that year.” Foe example, Arizona offers a 25% tax credit up to a $1,000 maximum amount. New York offers a 25% solar tax credit up to a maximum amount of $5,000. Most state tax credit incentives can be stacked on top of the ITC, allowing you to save more on your solar energy system. The percentage you get back decreases to 26% for systems installed in 2033 and 22% for systems installed in 2034.

Sales or property tax exemptions Some states may allow you to not pay taxes on your solar panels. A sales tax exemption means that you won’t pay any immediate one-time taxes on your solar panels and mounting equipment, while a property tax exemption means your home will be taxed based on its value before the solar installation. For example, Colorado exempts solar panels on residential properties from Colorado property taxation. Other states might only offer sales or property tax exemptions to businesses that install solar energy systems.

Solar rebate programs Solar rebates are incentive programs that encourage homeowners to install solar panel systems. Some state governments, like Pennsylvania, offer a certain amount of money back per watt in the solar project. Local utility companies might also offer rebates. Utility company rebates are subtracted from your system’s cost before you calculate your ITC, which may reduce what you get back. State government rebates usually do not reduce your federal tax credit.

Solar renewable energy certificates (SRECs) SRECs are certificates that are bought and sold in an open market that are only operated in certain states. You get 1 SREC for every 1 mWh (or 1,000 kWh) of electricity your solar panels generate. By generating and selling SRECs, you can use the money you earn to lower your solar energy bills. States with SREC markets: VT, NH, MA, NY, PA, NJ, DC, DE, MD, NC, SC, OH, MI, MN, IL, MO, CO, NM, AZ, NV, UT, OR, and WA. Utility companies buy SRECs to meet state renewable portfolio standards, which require them to have a certain percentage of electricity from renewable sources. Since SRECs exist in a market, their prices may vary widely based on supply and demand.

Community solar farms A community solar farm is a bank of solar panels that households and businesses can use to save money. When you subscribe, you pay a monthly subscription fee for a share of the electricity generated by the farm. In exchange, you get credit to apply directly to your monthly electric bill, which reduces the amount you pay. Solar farms typically save you between 5 to 15% on your electric bills, but this may vary by location. Since you don’t need to install the solar panels, there are no upfront costs. Many subscriptions also have short terms or pay-as-you-go options. Energy.gov’s spreadsheet includes the current community solar farm programs that are available to enroll in in your state. In some states like Colorado, community solar farms may be exempt from paying additional property taxes.

What’s the best way to finance solar panels?

The best solar panel financing option is a low-interest solar loan. Solar loans can save you between 40 to 70% over your solar panels’ lifetime. A loan also allows you to own the equipment yourself and qualify for federal and state tax credits. Compare the differences between loans, leases, and other options: Paying with cash: You pay a high upfront cost, but you own the panels and are eligible for tax credits and other incentives. Solar loans: You pay interest rates and risk losing the system if you can’t keep up with the payments, but you own the system and are eligible for government incentives. Solar leases or PPAs: You rent your system and won’t receive government incentives, but you save on energy costs and the utility company is responsible for maintenance. Cash-out refinance or Home Equity Line of Credit (HELOC): You risk losing your home and paying closing costs or variable interest rates, but you own the system and can take advantage of incentives.

Choosing a Solar Energy Installer

Get a cost estimate from local installers and compare them. Solar installation companies may have different rates for the same job, so it’s important to compare multiple quotes in your area. Most local companies will come to your house and give you an estimate based on your home’s size, layout, energy usage, and other factors. Make sure to ask each solar panel company about their financing options. If you’re taking out a loan with a bank, ask them about its interest rate and fees. Berkeley National Laboratory’s report includes the average solar prices in each state—to compare your estimate, divide the cost of the system by the system's capacity in watts (convert kilowatts by multiplying the number by 1,000). The average household needs about 17 to 21 solar panels to power their home. However, this can vary by location, the size of your house, and the specific panels you buy.

Check your installer’s credentials with certified energy organizations. Make sure the installer is licensed, bonded, and insured to sell solar energy products in your area. Look for solar installation companies with certifications from the North American Board of Certified Energy Practitioners (NABCEP)—these tend to meet the gold standard. Find solar companies accredited with the Better Business Bureau (BBB) in your area using their handy search tool. Try to work with installers who have at least 3 years of experience and are knowledgeable about all aspects of the process.

Read online reviews from past customers and clients. Read third-party online reviews on sites like Google or Trustpilot, and ask your installer to point to previous clients who can share their installation experience. Try to be cautious of any companies that have consistently negative reviews, complaints, or legal issues. If you have friends or neighbors who recently installed solar panels, ask them about their experience and ask if they’d recommend their installation company.

Try to avoid companies that use aggressive sales tactics. “Act now” tactics, unsolicited calls, and door-to-door pitches are all warning signs of salespeople who try to push you into making a deal without comparing your options. Companies offering “free” solar panels also use misleading tactics that can push you into leasing a system.

Try to avoid paying for your solar panels up-front. Most reputable solar installation companies will ask you to pay a deposit up-front and give them the rest of the money after the job is complete. Make sure your system is fully installed, functioning properly, and passes inspections before paying the rest of your bill. A trustworthy solar installer will be upfront with you about the process and the price. They’ll also be willing to answer any questions you have at any time. If your installer uses contractors, make sure you know what part of the project they handle and how your installer will oversee them.

Comments

0 comment