views

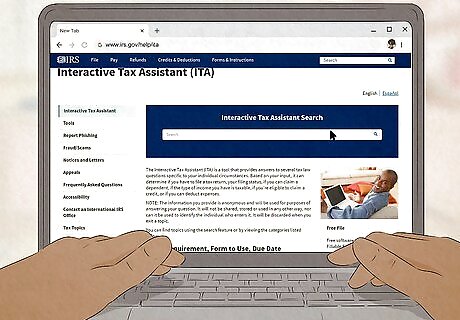

- Try to get your question answered through the IRS's interactive tax assistant at https://www.irs.gov/help/ita.

- Call 800-829-1040 Monday through Friday from 7am to 7pm local time to speak to an IRS agent.

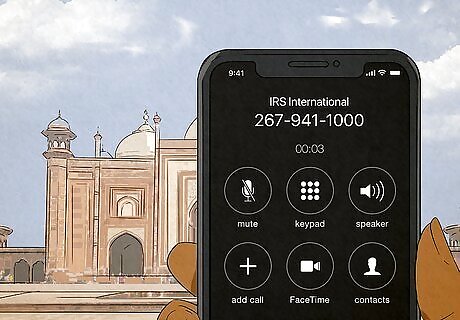

- If you live in another country, call 267-941-1000 Monday through Friday from 6am to 8pm Eastern time.

- Make an appointment at your nearest Taxpayer Assistance Center by calling 844-545-5640.

By Phone

Call 800-829-1040 for answers to most personal tax questions. Agents are standing by on this number from 7am to 7pm local time (Pacific time for Alaska and Hawaii residents) Monday through Friday. Progress through the automated menu to get to live agent options—just repeatedly saying "agent" or "representative" won't work. Once you're on hold, expect to wait at least 10-15 minutes to get through to an agent. Wait times are slightly longer in the post-filing season (May through December) and on Mondays and Tuesdays throughout the year. If you're hard of hearing, call the TTY/TDD number at 800-829-4059. You can also use this number if you are a resident of Puerto Rico or the US Virgin Islands. This line is only for individuals who have questions about their personal tax returns. If you need help with a business return, call 800-829-4933.

Call 267-941-1000 if you live in another country. Unlike the domestic number, this one is not toll-free. Agents are available to answer tax law questions from 6am to 8pm Eastern time, and from 6am to 11pm for all other tax-related questions.

Use 800-829-3676 to order forms and instructions. If you're working on your taxes and need paper forms or instructions, this is the number for you. You might be able to order forms through this number that you can't find for download at https://www.irs.gov/forms-instructions. From this number, you can also order paper copies of other publications the IRS makes available to assist taxpayers in filling out and filing their returns. Just follow the prompts.

Call 800-908-4490 for identity theft assistance. Use this number if you have evidence that your identity has been stolen, or if your information has been compromised and you believe you're at risk of identity theft. The IRS has specialists standing by to assist and they'll guide you through your next steps. The IRS might place an Identity Theft Indicator on your account. This means if someone else attempts to file taxes using your Social Security number, the IRS will flag and reject that false return. If you know that your sensitive information was stolen or compromised, fill out the Identity Theft Affidavit, available at https://www.irs.gov/pub/irs-pdf/f14039.pdf.

Online

Use the interactive tax assistant for answers to general tax questions. Go to https://www.irs.gov/help/ita to use the interactive tax assistant (ITA). This feature can help you with any specific tax law questions you have, including whether you have to file a return, what your filing status is, whether you can claim a dependent, whether the type of income you have is taxable, and if you're eligible to claim any credits or deductions. Just start typing your question to find the answer you need. There are a number of categorized questions on the ITA home page that you can also browse and see if any of them might apply to your situation. Since the ITA is available 24/7/365, it's a fast and convenient way to get your questions answered—and the answers are just as reliable as any you'd get from a live agent. The IRS doesn't have a live customer service chat or text chat option where you can talk to a live agent.

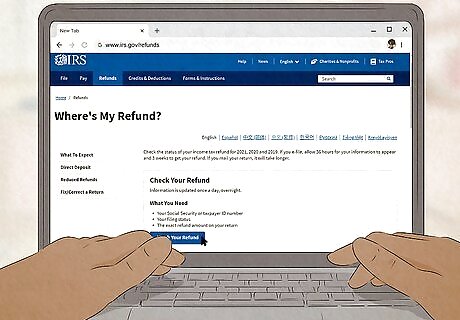

Go to the Refund Status Checker to find out when you'll get your refund. Just navigate to https://www.irs.gov/refunds and click on the blue "Check Your Refund" button. Provide your Social Security or taxpayer identification number, your filing status, and the exact refund amount listed on your return. If you e-filed your tax return, wait at least 36 hours for your information to enter the system. It'll take longer if you mailed your return (likely at least a couple of weeks). You can also check your refund using any mobile device through the free IRS2Go app, available at https://www.irs.gov/newsroom/irs2goapp.

Contact the IRS through the website—there isn't a customer service email. The IRS doesn't have email addresses for taxpayer assistance and doesn't recommend trying to ask personal tax questions through email because it's not secure. An email could easily be intercepted and read by a third party, which could open you up to identity theft. Any electronic communication you have with the IRS will typically be through your account on the IRS website. General tax questions can typically be answered by the interactive tax assistant if you're looking for a way to get help from the IRS without making a phone call. If you have a more complex issue that you're not able to figure out using the interactive tax assistant, you might want to reach out to a lawyer, CPA, or other tax specialist for help.

In Person

Make an appointment at your local Taxpayer Assistance Center. Go to https://apps.irs.gov/app/office-locator/ and enter your location information to find the closest Taxpayer Assistance Center. Then, call 844-545-5640 to make your appointment. Appointments fill up quickly close to the tax deadline. If you have questions related to the current year's tax return, don't put off scheduling an appointment!

Bring identification and documentation with you to your appointment. At a minimum, bring with you a current, government-issued photo ID and a taxpayer identification number (such as your Social Security number). Then, bring along any documents that are specifically related to the issue you want to talk to an IRS agent about. For example, if you have a question about deductions, bring with you copies of all receipts, invoices, and other documents related to the expenses you want to deduct.

Call the Taxpayer Advocate Service (TAS) for more complicated issues. This free service can help you if you're experiencing financial hardship or have a dispute with the IRS you can't resolve. Call 877-777-4778 to request assistance. You can also fill out the form available at https://www.irs.gov/pub/irs-pdf/f911.pdf and mail or fax it to your local TAS office. TAS has offices in all 50 states and Puerto Rico. To find the office closest to you, go to https://www.taxpayeradvocate.irs.gov/contact-us/#FindlocalTAS and select your state or territory from the drop-down menu. Not sure if you qualify for TAS help? Use their screening tool, available at https://www.taxpayeradvocate.irs.gov/can-tas-help-me-with-my-tax-issue/.

Responding to a Notice

Read the notice carefully. Any IRS notice you receive in the mail includes all the information you need to identify the issue and understand how to respond. If your response is required, the notice will probably also include a deadline, so be on the lookout for that. For example, if the IRS needs additional documentation from you, the notice will tell you exactly what types of documents the agency needs so you can get those together. If there's a deadline to respond, make sure you respond in some way before that date. Otherwise, the IRS could tack on more interest and penalty charges to what you owe. If the IRS says you owe money, don't put off paying because you can't pay the full amount. Just pay what you can before the deadline and try to work out a payment plan.

Call the number provided if you need more information. Every IRS notice has a contact number in the top right-hand corner. Use that number, rather than the general customer service number, if you have any questions about the notice you received. Calling is always your best option, especially if a deadline is looming, because you'll get an immediate response. For example, if the notice states that the IRS needs additional information to process your return, you could call and find out exactly what documents would work and how you can get those documents to the IRS as quickly as possible.

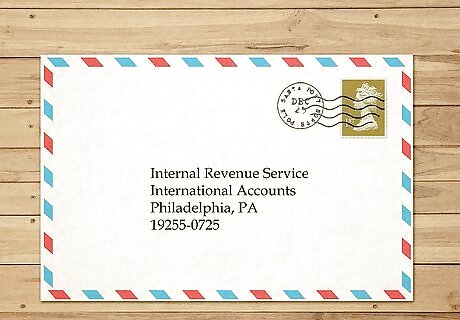

Mail correspondence to the address on the notice as a last resort. The notice you received will always have a return address on it. If you need to send documentation or if you want to mail a payment, this is the address to use. Always use certified mail with return receipt requested. It's a little more expensive than regular mail, but you'll have proof the IRS received your correspondence. That receipt is even accepted as proof in court (if the issue ever gets to that level). If you're writing to ask a question, the IRS warns it could take at least 30 days for you to get a response back. If you live in another country, send any questions you have to:Internal Revenue ServiceInternational AccountsPhiladelphia, PA19255-0725

Comments

0 comment