views

Tokya: Wipro Ltd, India's third-largest software exporter, is scouring Europe and the United States for acquisitions and is on track to boost IT services revenues by one-third this quarter, its billionaire chairman said on Friday.

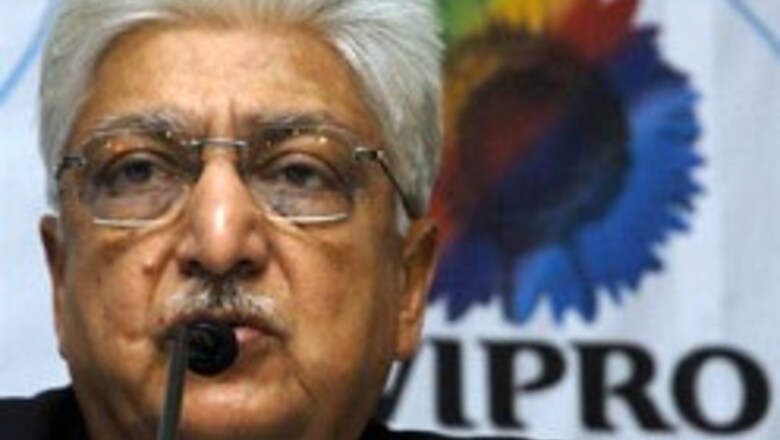

Azim Premji, one of India's richest men by virtue of his more than 80 percent stake in the $15 billion company, also told Reuters in an interview that Wipro aimed to boost sales in Japan by more than 50 per cent in the year to next March to $90 million.

Japanese and European companies have aggressively embraced Indian software services firms, keen to cut costs by outsourcing key processes such as supply chain design and payroll accounting to India's army of low-cost, English-speaking developers.

Wipro has been swallowing up smaller players to help it remain ahead of the industry's growth.

Armed with about $1 billion in cash, it has made four acquisitions since December including Quantech Global Services, which provides computer-aided design and engineering services to the auto and aerospace sectors.

It is eyeing more targets in Europe and the United States.

"It is a string-of-pearls approach. We are not doing large acquisitions. We are doing mid- to small-sized acquisitions, typically companies between $20 million and $70 million in terms of revenue," said Premji, in Tokyo to meet with clients and staff.

The white-haired chairman sees his main competition in India-based Infosys Technologies and Tata Consultancy Services, as well as IBM and Accenture, which are building up their presence in India in a big way.

After the sudden death of his father in 1966, Premji took charge of Wipro at the age of 21 when the $ two million company was making cooking fat.

Now it designs software for the world's top electronics makers and is India's seventh most valuable firm.

But Premji said Wipro could not afford to sit on its hands, especially with low-cost software companies emerging in China, Eastern Europe and Russia looking to leverage cheap and well-educated work forces to beat Wipro at its own game.

He said Wipro aimed to boost the percentage of sales generated by high-margin consultancy services to about 10 percent in the medium term, up from about five per cent now.

"We have to drive up the value chain," Premji, 61, said.

On Track

Industry revenue for the year ended in March 2006 is expected to have surpassed $23 billion, compared with $17.5 billion in the previous year, as outsourcing to Asia's third-largest economy shifts to longer-term contracts from piecemeal deals.

Against that backdrop, Premji said Wipro was on track to hit its forecast for IT services revenues to rise 34 per cent to $533 million in its fiscal first quarter to end-June, with operating margins holding "steady" around the prior quarter's 24.5 per cent.

"On one side you have salaries going up. On the other side you are always driving productivity, you are driving some improvement in pricing and the rupee is weak," said Premji, an electrical engineering graduate of Stanford University.

In Japan, Wipro is focused on boosting sales to existing customers in Japan such as electronics conglomerates Sanyo Electric Co and Toshiba Corp, rather than adding to the number of companies on its client list.

Premji reckons Japanese firms can save up to 30 percent by outsourcing their software needs to his company.

"And once our relationship gets more intimate and they get more confidence in us, we start doing work for them on a service-level agreement basis where we commit to them certain productivity improvements year-to-year," he said.

Wipro, which is also listed in New York, has about 1,100 engineers working for Japanese customers, of whom 250 are based in Japan and the rest in India and China.

Comments

0 comment