views

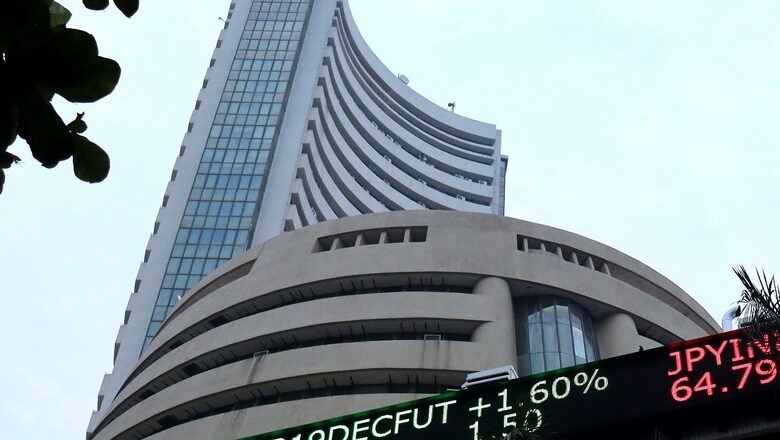

The Indian equities ended in the green zone on Monday, the BSE Sensex closed at 56,889.76, up 765.04 points, or 1.36 per cent. While the broader market Nifty50 rose to Rs 16,931, up 225.85 points, or 1.35 per cent. At 1537, on NSE, Bharti Airtel, Axis bank, Tata Steel, Coal India were the top gainers. The scrip of Bharti Airtel rose 5.02 per cent, Axis Bank rose 4.24 per cent, Tata Steel by 3.80 per cent.

However, Tech Mahindra after shedding 1.43 per cent was the top loser on the NSE, Nestle India, Eicher Motor, Infosys, Wipro were following the Tech Mahindra among the list of laggards, On BSE, Greaves Cotton with 10.20 per cent rise in the scrip was the gainer, and Bliss GVS Pharma was just behind it with the rise of 10.20 per cent.

“Indian markets started on a positive note following positive Asian market cues on back of U.S. Fed chairman statement indicating that the central bank is likely to begin tapering before the end of the year, though there is still much ground to cover before rate hikes. During the afternoon session markets continued to trade positive and scaled new highs with broad based buying in blue chip counters. Most of the sectoral indices were trading in green. Apart from blue chips, broader indices too equally participated in the rally with both mid and small cap indices trading up by over 1.50% each. In another positive development, Niti Aayog Vice-Chairman has said a strong economic growth rebound is expected on the back of rapid vaccinations, a recovering monsoon boosting agricultural output, thrust on infrastructure investments by the government, and growth in export, which have performed remarkably during April June registering a growth of 18% over the same period in the pre-pandemic year of 2019-20,” Shrikant Chouhan, executive vice president, Equity Technical Research, Kotak Securities Ltd said.

At close, S&P BSE MidCap was up 1.72 per cent and SmallCap 1.55 per cent. 26 shares advanced, 4 shares declined at close on the BSE. However, all indices closed in green barring Nifty IT which was down by 0.58 per cent. The volatility gauge VIX cooled to 13.32, down 0.65 per cent.

“Indian markets started on a positive note following positive Asian market cues on back of U.S. Fed chairman statement indicating that the central bank is likely to begin tapering before the end of the year, though there is still much ground to cover before rate hikes. During the afternoon session markets continued to trade positive and scaled new highs with broad based buying in blue chip counters. Most of the sectoral indices were trading in green. Apart from blue chips, broader indices too equally participated in the rally with both mid and small cap indices trading up by over 1.50% each. In another positive development, Niti Aayog Vice-Chairman has said a strong economic growth rebound is expected on the back of rapid vaccinations, a recovering monsoon boosting agricultural output, thrust on infrastructure investments by the government, and growth in export, which have performed remarkably during April June registering a growth of 18% over the same period in the pre-pandemic year of 2019-20,” Narendra Solanki, head- equity research (Fundamental), Anand Rathi Shares & Stock Brokers on market performance said

In early trade, taking cues from the supportive global cues, the market opened in positive territory. The BSE Sensex was up 321.99 points or 0.57 per cent at 56,446.71, and the Nifty was up 103.30 points or 0.62 per cent at 16,808.50. Apart from Indian market, other Asian bourses on Monday also opened in the positive territory. Japan’s Nikkei rose 0.9 per cent soon after the bell, and MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.32 per cent in early trading before Chinese markets had opened. Australian markets opened in green, up 0. 39 per cent and similarly, Korea’s Kopsi was up 0.54 per cent. 0702 hour, Nifty Futures on the Singaporean Stock Exchange was trading in the red down -3.50 points, or 0.02 per cent at 16,821 signaling that the Indian markets are headed for a negative start today.

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Comments

0 comment