views

New Delhi: The CBI's probe has shown that the Satyam Computer scam involves a much bigger amount, close to Rs 10,000 crore, than what was disclosed by the IT company's founder Ramalinga Raju.

Sources said the agency has retrieved over 7,000 fake invoices and forged documents showing fixed deposits and bank balances and their evaluation shows that the size of the scam is over Rs 9,600 crore, much more than the Rs 7,800 crore disclosed by Raju on January 7.

They said the investigating agency during the probe found that the accused relied heavily on technology to generate nearly 7,000 fake invoices to the tune of Rs 4,500 crore and fed the same into Satyam's books.

The sources said these inflated figures were also reflected in the balance sheet in the form of audit reports which helped the company to cheat the public who were purchasing its shares.

The buck did not stop here as the accused also have given false and fabricated statements, found by the CBI, about high capital of the company.

The accused forged documents and created fake fixed deposit receipts to the tune of Rs 3,300 crore.

The FDRs were shown by the accused as available deposits by the company, the sources said, adding the accused had also

allegedly manipulated the bank guarantees to show the balance in bank accounts as Rs 1,800 crore.

The CBI alleged that the accused had forged bank documents showing the existence of the cash balance in five banks including ICICI Bank, HSBC, Citibank and BNP Paribas but the banks clarified that they do not have any cash balance in the name of the firm.

The CBI is at present questioning the disgraced former chairman of Satyam, B Ramalinga Raju, and others including the auditors of PriceWaterhouse. Their custody was handed over to the CBI on Saturday for two days.

Besides Raju, his brother Rama Raju, Satyam's former CFO Vadlamani Srinivas, PW partners S Gopalakrishnan and Talluri

Srinivas are in jail awaiting trial in connection with the case dubbed as India's biggest corporate fraud.

PAGE_BREAK

In a related development, the CBI was examining the "digital evidence" about the share transactions at National Stock Exchange and Bombay Stock Exchange and did not rule out the possibility of questioning some officials of Securities and Exchange Board of India (Sebi), the capital market regulator. Sebi too is independently probing the fraud.

The CBI was probing the rotation of funds and role of front companies used in rotation of funds, the sources said, adding that it was found that the accused had floated more than 320 companies and nearly 60 companies had same addresses.

Experts including Chartered Accountants from the Institute of Chartered Accountants of India (ICAI) and Institute of Cost and Works Accountants of India (ICWAI) are also assisting the CBI in probing the role of the regulator in this case, the sources said.

The CBI registered a case against Raju and others for their alleged involvement in what it called a unique accounting fraud at the Hyderabad-based company.

The scam has made the CBI constitute a Multi-disciplinary Investigation Team (MDIT) headed by Deputy Inspector General VV Lakshmi Narayana which will be headquartered in Hyderabad to undertake a thorough probe.

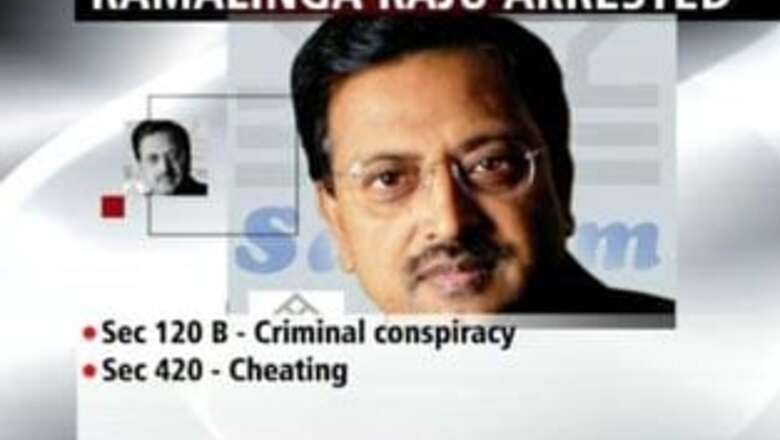

The case against them was registered under 120-B (criminal conspiracy), 409 (criminal breach of trust), 420 (cheating), 467 and 468 (forgery), 471 (using forged document as genuine), 477-A (falsification of accounts).

The case was handed over to the CBI on February 18 by the Centre after a request for the same was received from the Andhra Pradesh government.

On January 7, Raju disclosed to fudging accounts and inflating profits over the last several years. He was arrested by the Andhra Pradesh Police on January 9.

Comments

0 comment