views

RBI Monetary Policy Meet: The Reserve Bank of India, or RBI, on December 8, Wednesday is set to announce its decisions made during the meeting of the bi-monthly Monetary Policy Committee meet that took place earlier. “Watch out for the Monetary Policy statement by the RBI Governor @DasShaktikanta at 10:00 am on December 08, 2021," the central bank wrote on its Twitter handle a day back. The Reserve Bank of India is likely to keep the interest rates unchanged at record lows given the emergence of the new variant of COVID-19, which is Omicron, according to most analysts. During the last MPC meet of India’s central bank, the repo rate was kept unchanged.

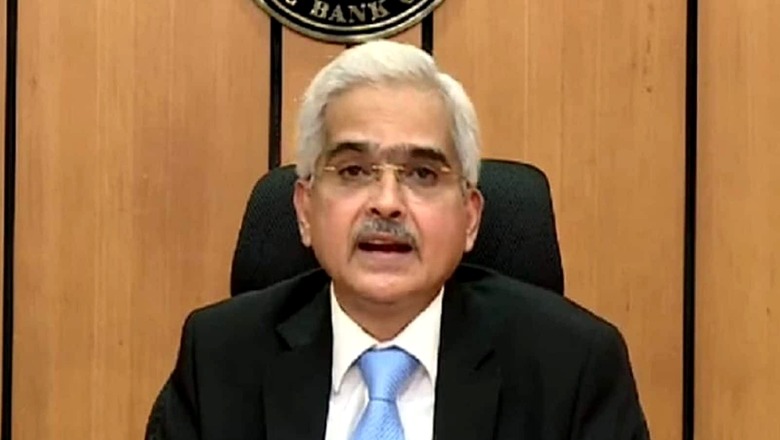

RBI Governor Shaktikanta Das will make the announcements on Wednesday, December 8, at 10 am IST. His speech will be streamed live on various platforms.

Here is How to Watch RBI Monetary Policy Decisions LIVE Today

YouTube: You can watch the LIVE address of RBI governor Shaktikanta Das on YouTube using the following link:

Facebook: The address will be simultaneously streamed on Reserve Bank of India’s Facebook page.

Twitter: RBI Governor Shaktikanta Das’ address to the country will also be streamed on the Central Bank’s official Twitter handle @RBI.

You can also keep an eye on the News18 Live Blog for the MPC meet, which will be updated with latest news.

The Reserve Bank of India governor will also address a press conference after the announcing the decisions at 12 pm. One can watch it live on YouTube at

https://youtu.be/nA9YhLwV9RA.

There have been widespread speculations about the central bank keeping the interest rates stable amid the pandemic and its potential third wave with the emergence of the Omicron variant. All 50 economists polled by Reuters expected the MPC to hold rates at its December 8 meeting. “We were previously expecting the RBI to hike the reverse repo rate 15-20 bps in December, but given the uncertainty emerging from the new COVID-19 variant, we now expect status quo," Morgan Stanley economists wrote.

“…we believe the talks of a reverse repo rate hike in the MPC meeting may be premature as RBI has been largely able to narrow the corridor without the noise of rate hikes and ensuing market cacophony," said an SBI research report earlier. According to it, the RBI is not obliged to act on reverse repo rate only in MPC. “Also, change in reverse repo rate is an unconventional policy tool that the RBI has effectively deployed during crisis when it moved to a floor instead of the corridor," it added.

“Given the uncertainties associated with the scale of economic recovery, the RBI is expected to maintain its growth focus and continue with the accommodative monetary policy stance even as it moves towards gradual normalization. MPC is likely to maintain key interest rates i.e., the repo rate and reverse repo rate at a record low of 4% and 3.35% respectively. Policy rate hike unlikely before Q1 FY23. The reverse repo rate corridor (over the repo rate) could be narrowed from the current 65 bps in a graded manner from February 2022," said experts at Care Ratings.

If the RBI maintains status quo in policy rates on Wednesday, it would be the ninth consecutive time since the rate remains unchanged. The central bank had last revised the policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

Indian economy remained on track to post the fastest growth among major economies this year as its GDP expanded by 8.4 per cent in the July-September quarter to cross pre-pandemic levels. The near term Indian CPI is likely to remain within the MPC target band of 4 to 6 per cent.

(With PTI inputs)

Read all the Latest Business News here

Comments

0 comment