views

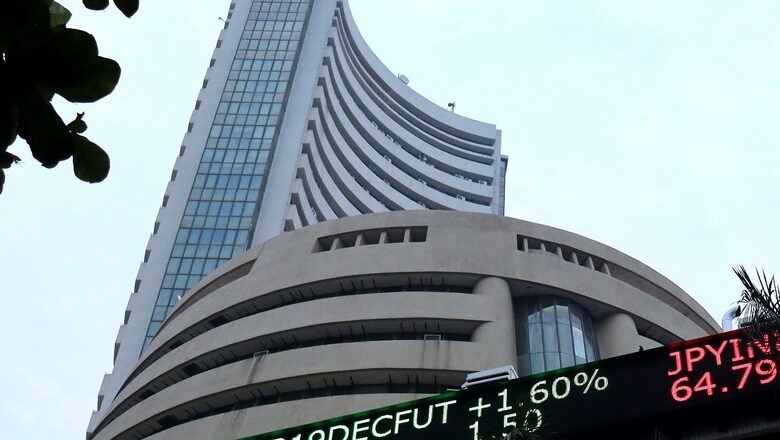

According to a new analysis report by the American investment and financial services giant, Goldman Sachs, with the current the trajectory of the Indian stock market, the country could surpass developed nations like the United Kingdom by 2024. This will bring India in the fifth position among the largest stock markets in the world.

With more than 800 million internet users and roughly half a billion people who own a smartphone, the country’s start-up ecosystem, especially in the realm of technology, is exceptionally fruitful and is geared up to foster many more startups. According to Goldman’s analysis, Indian start-ups have raised more than $10 billion through Initial Public Offerings (IPO) this year. The money raised is more than what was raised in the past three years.

The aggregate stock market value of India amounts to roughly $3.5 trillion. However, with the proliferation of the IPOs of various start-ups in the pipeline, India’s stock market value could cross the $5 trillion mark in the next three years. According to reports, India currently has more than 60 unicorn start-ups, including giants like Zomato, BYJU’s, and Paytm, which makes the South Asian country the fastest-growing startup ecosystem in the World.

According to a CNBC report, Goldman’s analysts estimate that in the coming two to three years, India could witness a rise of around $400 billion in its market cap.

“As exciting as China was over the last few decades, we at Goldman Sachs are flagging a new China story involving ultra-profitable and successful investments, beginning to develop in India,” Timothy Moe, Goldman Sachs’ Asia Macro Research Co-head, told CNBC.

In India, the food delivery platform, Zomato, was the first to get publicly listed. Proving to be a very successful move by the company, Zomato raised roughly $1.26 billion in their initial public offering, with their shares priced at Rs.76 each. The next in line are equally gigantic tech-startups like Paytm, Ola, and Flipkart.

India’s technological growth rate has proliferated beyond the charts and does not seem to stop anytime soon. With the pandemic shifting major businesses online, be it education, payments, or grocery shopping, along with the data rates that saw a steep fall after the launch of JIO, India is very fertile for start-ups as well as investments.

Keywords: Goldman Sachs, India, United Kingdom, Stock Market, Investment, IPO, $5 trillion, Fifth, World

Read all the Latest News , Breaking News and Ukraine-Russia War Live Updates here.

Comments

0 comment